Construction giant Carillion asked the Government to provide funds of £20 million to help it secure more money from the banks and avoid going into liquidation, it has been claimed.

Talks were held throughout the weekend between Government ministers and company officials in a bid to keep Carillion in business, but they broke up on Sunday evening without a deal.

Sources told the Press Association that Carillion wanted £20 million to help it secure more funds from banks, a far lower figure than had been previously speculated, but ministers were unwilling to offer financial support.

The Cabinet Office decline to comment.

Carillion’s fall into compulsory liquidation has put thousands of jobs at risk, but the Government said staff should go to work and would continue to be paid.

Many small firms are also waiting for Carillion to pay bills going back several months.

Prime Minister Theresa May’s official spokesman said that, initially, the Government will be paying staff through the Official Receiver to ensure that public services continue to run as normal.

He said these payments will be the same as would have been provided to Carillion had they been able to continue, adding that there would be some additional burden on the taxpayer from the cost of the receiver.

Carillion is understood to have public sector or public/private partnership contracts worth £1.7 billion, including providing school dinners, cleaning and catering at NHS hospitals, construction work on rail projects such as HS2 and maintaining 50,000 Army base homes for the Ministry of Defence.

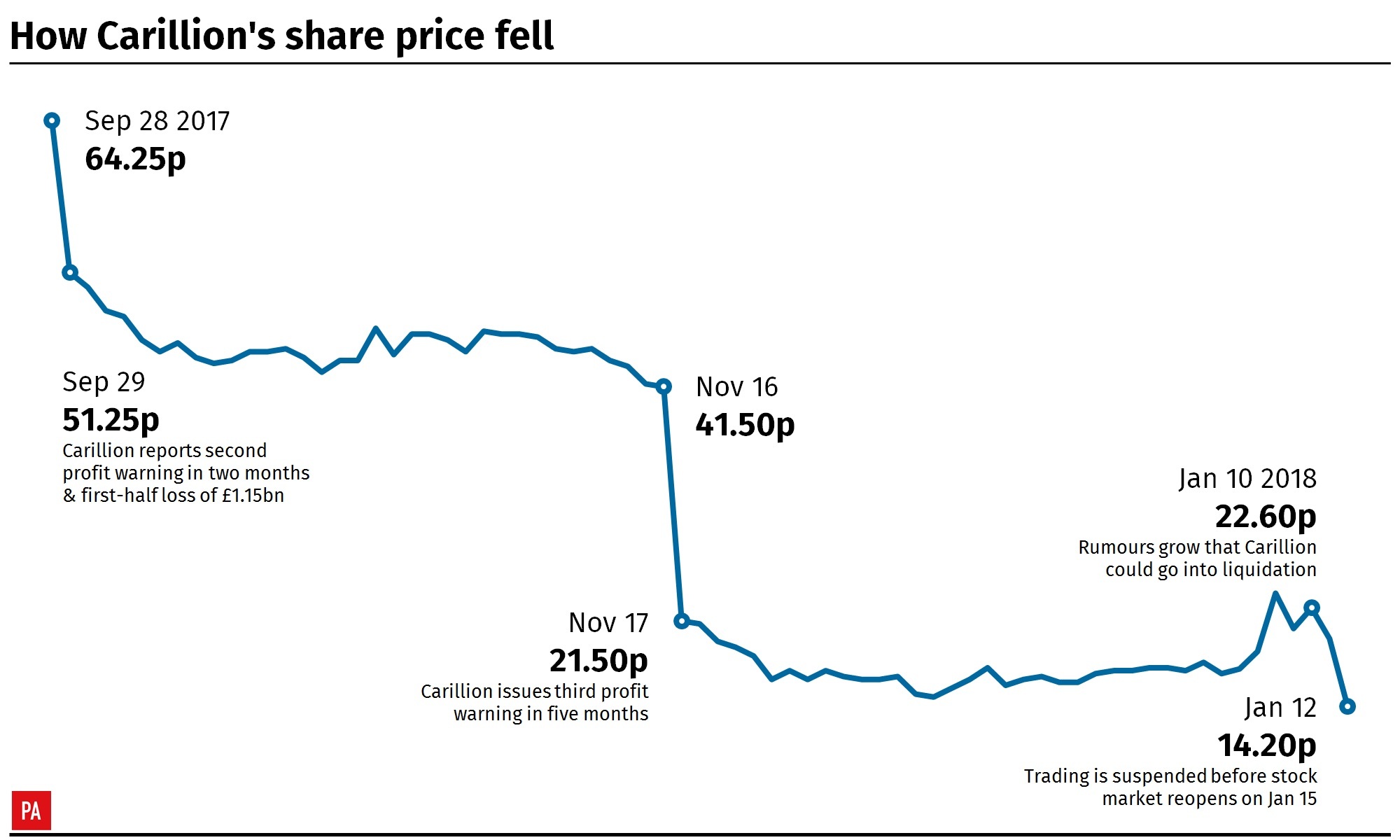

It has seen its shares price plunge more than 70% in the past six months after making a string of profit warnings and breaching its financial covenants.

Shares in Britain’s second biggest construction firm were suspended after it was announced that the Official Receiver and accountancy giant PwC would oversee a liquidation process.

The group, which employs around 20,000 British workers, has been struggling under £900 million of debt and a £587 million pension deficit.

Lenders including HSBC, Barclays, Santander and Royal Bank of Scotland are reportedly set to lose an estimated £2 billion as a result of the collapse.

Carillion chairman Philip Green said: “This is a very sad day for Carillion, for our colleagues, suppliers and customers that we have been proud to serve over many years.”

The group’s demise has posed questions as to why Carillion continued to receive Government contracts despite issuing a number of profit warnings.

2016 Carillion annual report says dividend ‘has increased in each of 16 years since formation of company’; Is this really acceptable alongside a pension fund deficit over half a billion pounds?

— Steve Webb (@stevewebb1) January 15, 2018

Asked whether it had been a mistake to continue awarding contracts to Carillion, the PM’s spokesman said: “Since July, we have kept a very close eye on this, but of course if there are lessons which can be learned, they will be.

“The receiver will carry out a full investigation and we will look at the findings.”

Concerns have also centred on former Carillion chief executive Richard Howson, who pocketed £1.5 million in salary, bonuses and pension payments during 2016.

As part of his departure deal, Carillion agreed to keep paying him a £660,000 salary and £28,000 in benefits until October.

Steve Webb, the former pensions minister, also questioned why the company had increased its dividend payments when it was grappling with a hefty pension deficit.

In a tweet, he wrote: “2016 Carillion annual report says dividend ‘has increased in each of 16 years since formation of company’; Is this really acceptable alongside a pension fund deficit over half a billion pounds?”

Carillion retirees already receiving their pensions will continue to receive payments, the Government has assured.

However, there are around 27,000 staff involved in its defined benefit schemes which are likely to be transferred to the Pension Protection Fund.

A spokesman from the PPF said: “We want to reassure members of Carillion’s defined benefit pension schemes that their benefits continue to be protected by the PPF and will continue to be protected if or when their scheme enters the PPF assessment period.”

HMG has big questions to answer. Why were they awarding contracts to Carillion after the exposure of its problems in July? What contingency planning did they do for the collapse? 20,000 jobs & huge projects at stake! More Brexit-induced Whitehall paralysis & incompetence. https://t.co/dYZ4XUUWgn

— Andrew Adonis (@Andrew_Adonis) January 15, 2018

Unions have called for urgent reassurances over the jobs, pay and pensions of thousands of workers following the “disastrous” news.

Rail, Maritime and Transport union general secretary Mick Cash said: “The blame for this lies squarely with the Government who are obsessed with outsourcing key works to these high-risk private enterprises.”

Jim Kennedy, the Unite union’s national officer for local government, said a public inquiry was needed to answer questions about Carillion’s conduct and the Government’s decision to award it contracts.

#Carillion: Tens of thousands of jobs at risk, along with public services and major infrastructure projects. Govt must step in.

TUC statement: https://t.co/y84m4fD1GR

— TUC Press Office (@TUCnews) January 14, 2018

Cabinet Office Minister David Lidington said it was “regrettable” that Carillion could not find suitable financing options, but taxpayers could not be expected to bail out a private sector company.

It comes after the Financial Conduct Authority announced earlier this month that it had launched an investigation into the “timeliness and content” of announcements made by Carillion between December 7 2016 and July 10 2017.

Shadow business secretary Rebecca Long-Bailey said there were “extreme concerns” about the Government’s handling of the situation and said Whitehall should take Carillion contracts back in-house.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here