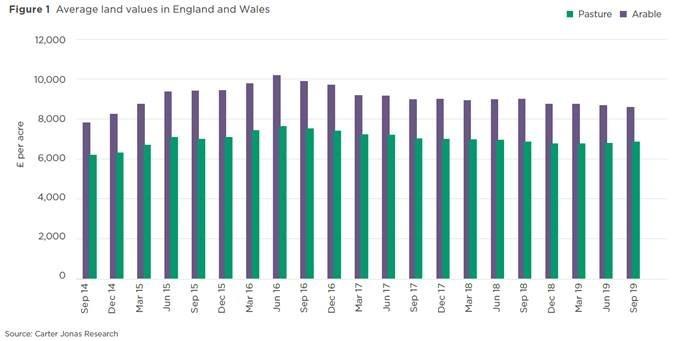

According to Carter Jonas, arable land averaged £8,564 per acre in Q3 of 2019 – down 1.2 per cent on the previous quarter and by 4.7 per cent over the last 12 months. Meanwhile pasture values increased slightly quarter on quarter by 0.8 per cent to £6,831 per acre, but also recorded an overall year-on-year decrease of 0.2 per cent.

However, despite short-term fluctuations, farmland values across England and Wales are still ten per cent above levels achieved five years ago.

As at the end of September 2019, publicly marketed land across the UK totally circa 83,000 acres this year – a 40 per cent decrease compared with the same period last year. Carter Jonas forecasts that supply levels are only likely to reach 110,000 by the end of 2019, which is well below the previous low in 2014. This could however be drastically different come the next Brexit deadline on October 31.

Andrew Fallows, head of Carter Jonas, said: “It is hard to know how the market will react when we leave the EU on October 31 – with or without a deal – so our forecast could change significantly. The uncertainty means that some buyers are unwilling to make large capital investments but there are still motivated individuals around. These buyers are more discerning, but the limited supply of land means that parts of the market are relatively robust as a result.

“Pricing is very much location dependent, but parcels of land with good access and assets with alternative income streams are still sought after and attracting strong interest. Since the relaxation of permitted development rights, the conversion of farm buildings to residential, office, light industrial and even energy generation has proved attractive as a way of securing non-farming revenue at a time of uncertainty.”

READ MORE: To lot or not to lot: deciding how to sell your property

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here