THE proportion of homes being snapped up by cash buyers has fallen to its lowest level since at least 2007, a report has found.

Across Britain, 28% of homes were bought with cash rather than a mortgage in the first half of 2019, Hamptons International has estimated.

This is down from a peak of 36% recorded in 2009 and the smallest proportion of cash sales since Hamptons' records started in 2007.

Aneisha Beveridge, head of research at Hamptons International, said: "The fall in cash purchases not only reflects tighter affordability, but also a decrease in activity amongst downsizers, the group of people most likely to have built up enough equity to purchase property with cash.

"It also reflects a drop off in the number of homes bought by investors, many of whom used cash to purchase their properties."

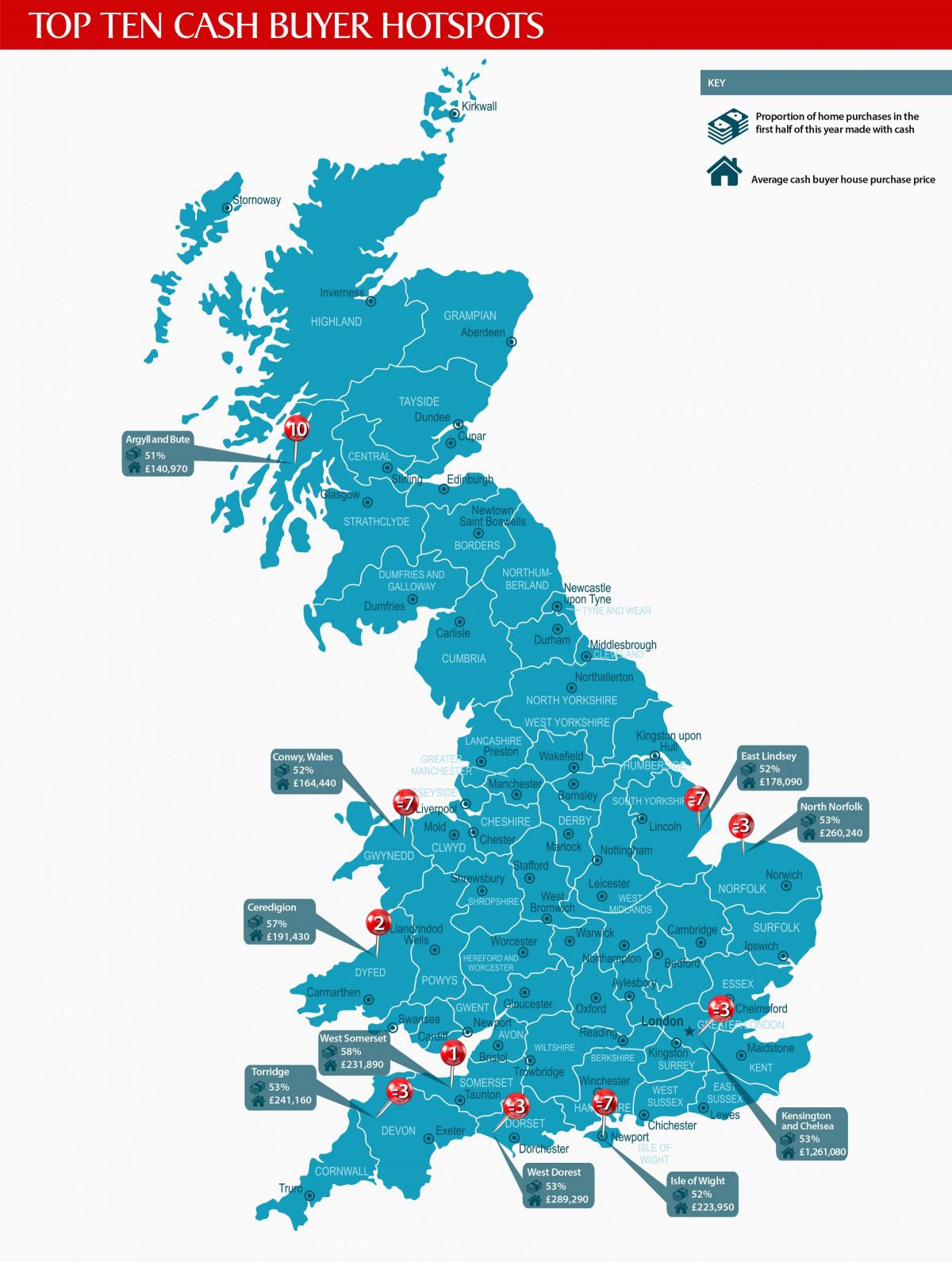

Despite the decline in the proportion of home buyers purchasing with cash, the report also identified some cash buyer hotspots.

More than half (58%) of homes purchases in West Somerset in the first half of this year were in cash.

Ceredigion (57%), Torridge (53%), West Dorset (53%) and North Norfolk (53%) followed as the top cash hotspots.

Kensington and Chelsea was the only London borough to feature in the top 10.

Some 53% of homes in the borough were purchased with cash in the first half of 2019 - at an average price tag of £1.26 million.

Hamptons International analysed data from its parent group Countrywide as well as official statistics to make the findings.

It found that, within the group of home buyers paying in cash, there had been a significant fall in the proportion who were investors.

Investors accounted for less than a quarter (24%) of cash sales in the first half of 2019, compared with nearly a third (32%) 10 years ago.

The majority (68%) of homes bought with cash this year were purchased by home owners wanting to live in the property - up from 61% 10 years ago.

Every nation and region of Britain has seen cash sales decline over the past two years.

The South West of England remains the region with the highest proportion of cash sales.

More than a third (34%) of homes were purchased with cash in the first half of 2019.

Meanwhile London had the lowest proportion of cash sales at less than a fifth (19%).

The average cash property purchase in London in the first half of this year was £489,820 - more than twice the typical cash purchase across Britain generally at £217,810.

Here are the proportions of cash buyers in the first half of this year by region, according to Hamptons International. Figures show the proportions of buyers who paid in cash and the average cash house purchase price:

- South West 34% £250,830

- Wales 32% £156,240

- North East 31% £116,610

- Scotland 30% £138,090

- North West 29% £149,890

- Yorkshire and the Humber 29% £155,310

- East Midlands 27% £185,200

- South East 27% £306,380

- East of England 26% £274,860

- West Midlands 23% £172,050

- London 19% £489,820

And here are the top cash buyer hotspots, with the proportion of home purchases in the first half of this year made with cash and the average cash house purchase price:

1. West Somerset, South West, 58%, £231,890

2. Ceredigion, Wales, 57%, £191,430

=3. Torridge, South West, 53%, £241,160

=3. West Dorset, South West, 53%, £289,290

=3. Kensington and Chelsea, London, 53%, £1,261,080

=3. North Norfolk, East, 53%, £260,240

=7. Conwy, Wales, 52%, £164,440

=7. East Lindsey, East Midlands, 52%, £178,090

=7. Isle of Wight, South East, 52%, £223,950

10. Argyll and Bute, Scotland, 51%, £140,970

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel