SOMERSET West and Taunton Council has splashed out £44million in eight months buying up a portfolio of business premises.

The six investment properties snapped up between August last year and March this year are in Scotland, the North of England and the Midlands.

A further property was bought last month, while the council says two more were also set for completion in April.

Discussions are being held with agents over the possible purchase of several more premises.

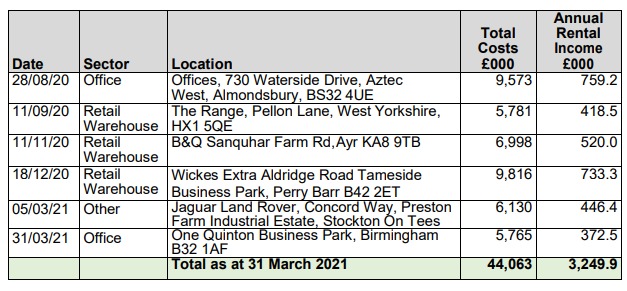

The six properties purchases to the end of March, which yield a total annual rent to SWT of £3.25million are:

- August 2020, an office in Almonsbury, cost £9.573million;

- September 2020, retail warehouse in West Yorkshire rented by The Range, cost £5.781m;

- November 2020, retail warehouse in Ayr rented by B&Q, cost £6.998m;

- December 2020, retail warehouse in Birmingham rented by Wickes, cost £9.816m;

- March 2021, car dealership premises in Stockton-on-Tees rented by Jaguar Land Rover franchise, cost £6.130m;

- March 2021, office in Birmingham rented by Highways Agency, cost £5.765.

If the two completions were finalised in April, the total layout by the council in nine months would be £68.6million.

By the end of March, SWT had looked at the possibility of buying 868 "investment properties".

A report to next week's corporate scrutiny committee says nine of those are 'active'; 16 are on a 'watch list'; and 825 have been rejected after being considered 'not suitable'.

There were nine unsuccessful bids.

Some of the properties purchased by Somerset West and Taunton Council

A report to corporate scrutiny says: "Despite the challenging economic conditions facing UK businesses and the economy the performance of the portfolio has been very strong.

"To date there have been no material rental defaults and during the period of September 2020 and March 2021 the market has seen a great deal of yield compression particularly in the retail warehousing and industrial markets.

"As a result the retail warehouse assets contained in the portfolio which were purchased earlier in 2020 will already have increased significantly in value potentially adding £1.75m of capital value to the value of the property."

The council, which has plans to potentially spend up to a total of £100m acquiring investments, is paying for its spending spree with loans with a repayment rate of 1.5 per cent.

The investment policy has been decided to cover the authority's budget gap caused by a fall in business rate income and New Homes Bonus grant.

The report says: "Council tax increases alone are not adequate to offset funding reductions and service cost pressures, with a 1 per cent increase in council tax income generating around £90,000 per

annum in additional income."

It adds: "Although the higher numbers of investors active in the market has made the further acquisition of property more difficult, the trade-off is the yield compression this has created has increased the capital value of the retail warehousing assets that SWT purchased earlier in 2020, when the market was very subdued and there was obvious value to be achieved particularly in the retail warehousing sector.

"As a result the retail warehouse assets contained in the portfolio will already have increased significantly in value potentially adding around £1.75m of capital value to the value of the portfolio.

"In addition, it is also likely the other assets in the portfolio will also have increased in value due to the secure nature of the income stream and the high quality of the properties but maybe not by such noticeable amounts."

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel