4.47pm

4.45pm

The Chancellor said income tax-free personal allowance will rise to £12,500 and higher rate threshold to £50,000 from April 2019, and both will be indexed to inflation from 2021/22.

He said the income tax threshold changes would amount to a tax cut for 32 million people, putting £130 a year in the pocket of a typical basic rate taxpayer.

Mr Hammond has concluded his statement.

4.42pm

Mr Hammond announced the National Living Wage will rise by 4.9%, from £7.83 to £8.21 an hour, from April 2019.

4.41pm

We have always been clear we want the migration [to Universal Credit] to be as smooth as possible. I have already delivered nearly £3.5 billion to help with the transition…Today I can go further, with a package of measures worth £1 billion over 5 years #Budget2018 pic.twitter.com/y6jmxBxD1w

— HM Treasury (@hmtreasury) October 29, 2018

4.40pm

The Chancellor announced Remote Gaming Duty on online games of chance will be increased to 21% from October 2019 to fund the loss of revenue as maximum FOBT stakes are cut to £2.

Meanwhile, Air Passenger Duty will be indexed in line with inflation, but there will be no change in the duty rate for short-haul flights.

4.37pm

Duty on beer, cider and spirits will be frozen for the next year, saving 2p on a pint of beer, 1p on a pint of cider, and 30p on a bottle of Scotch or gin compared to the inflation assumption in the OBR forecast. Duties on wine to rise in line with RPI inflation and white ciders to be taxed at a new higher rate.

…I will therefore be freezing beer and cider duty for the next year…keeping the cost of beer down for patrons of the Great British Pub ❄️🍻…I will also freeze duty on spirits… ❄️🥃 #Budget2018 pic.twitter.com/VMQkHn7DyS

— HM Treasury (@hmtreasury) October 29, 2018

Tobacco duty escalator to continue to rise at inflation plus 2%.

4.35pm

Fuel duties will be frozen for the ninth successive year, bringing the total saving to the average car driver to more than £1,000 and to the average van driver to over £2,500.

4.32pm

“We will introduce a new tax on the manufacture and import of plastic packaging which contains less than 30% recycled plastic…

…transforming the economics of sustainable packaging.

We will consult on the detail and implementation timetable.” #Budget2018 pic.twitter.com/4s3HwDjwBj

— HM Treasury (@hmtreasury) October 29, 2018

4.30pm

Mr Hammond said the Transforming Cities Fund will be increased to £2.4 billion, with an additional £90 million to trial new models of smart transport; funding for 10 University Enterprise Zones; £115 million for Digital Catapults in the North East, Northern Ireland, and the South East; £70 million to develop the Defence and National Rehabilitation Centre near Loughborough; £37 million of additional development funding for Northern Powerhouse Rail; and £10 million for a new pilot in Manchester to support the self-employed to acquire new skills.

Decisions announced in this Budget mean an additional £950 million for the Scottish Government, £550 million for the Welsh Government and £320 million for a Northern Ireland Executive in the period to 2020/21.

4.25pm

The Chancellor announced Stamp Duty will be abolished for all first-time buyers of shared ownership properties valued up to £500,000, applied retrospectively to the date of the last Budget.

He announced a further £500 million for the Housing Infrastructure Fund, designed to unlock a further 650,000 homes; a new wave of strategic partnerships with nine English Housing Associations to deliver 13,000 homes; and up to £1 billion of British Business Bank guarantees to support smaller housebuilders.

4.20pm

“We will now introduce a UK Digital Services Tax.

…It will be carefully designed to ensure it is established tech giants – rather than our tech start-ups – that shoulder the burden of this new tax.” #Budget2018 pic.twitter.com/h2hKxMrO1Y

— HM Treasury (@hmtreasury) October 29, 2018

The UK Digital Services Tax will be a narrowly targeted tax on the UK-generated revenues of specific digital platform business models, designed to target established tech giants which are profitable and generate at least £500 million a year in global revenue.

Mr Hammond also announced measures to clamp down on tax avoidance, evasion, and unfair outcomes which are expected to raise another £2 billion over the next five years.

Meanwhile, business rate bills will be cut by one-third for the next two years for all retailers in England with a rateable value of £51,000 or less, delivering an annual saving of up to £8,000 for up to 90% of all independent shops, pubs, restaurants and cafes.

The Chancellor said the £1,500 local newspaper discount is to be extended for a further year.

He also announced new mandatory business rates relief for all public lavatories made available for public use, whether publicly or privately owned.

4.15pm

Start-Up Loans funding will be extended to 2021, the Chancellor said, helping 10,000 entrepreneurs. The contribution of smaller firms to the apprenticeship levy will be reduced from 10% to 5%.

Employment Allowance will be targeted at small and medium businesses with an Employer NICs bill under £100,000 a year from April 2020.

Lettings Relief will be limited to properties where the owner is in shared occupancy with the tenant from April 2020.

The threshold for VAT registration will remain unchanged for a further two years. Reforms to IR35 payroll rules will be extended to large and medium-sized firms in the private sector from April 2020.

4.10pm

Mr Hammond announced that the Government is abolishing the use of Private Finance Initiative and PFI2 schemes for future projects.

The National Productivity Investment Fund is to be expanded to over £38 billion by 2023/24, so that over the next five years, total public investment is growing 30% to its highest sustained level in 40 years, including spending on roads, railways, research, and digital infrastructure.

4.05pm

Mr Hammond announced a £400 million in-year bonus to help schools buy kit – a one-off capital payment direct to schools worth an average of £10,000 per primary and £50,000 per secondary.

He also said an additional £420 million is being made available immediately to local highway authorities to tackle potholes, bridge repairs and other minor works in this financial year.

Mr Hammond said the Treasury will make a £10 million donation to mark the Centenary of the Armistice by supporting veterans with mental health needs, as well as grants for refurbishment of village halls equivalent to the VAT chargeable on such projects and £1.7 million for school educational programmes in schools to mark the 75th anniversary of the liberation of concentration camps.

Marking the centenary of the First World War this year the Chancellor makes a number of commitments in commemoration, including "£10m to the Armed Forces Covenant Fund Trust to support veterans with mental health needs." #Budget2018 #WW1 pic.twitter.com/EUiWQ7amrA

— HM Treasury (@hmtreasury) October 29, 2018

Meanwhile, air ambulance services in England will receive £10 million in state funding.

4pm

The Chancellor announced an additional £160 million in funding for counter-terrorism police for 2019/20.

“Today I commit an additional £160m of Counter Terrorism police funding for 2019-20…” #Budget2018 👮♂️👮♀️ pic.twitter.com/nYWxZcKEl6

— HM Treasury (@hmtreasury) October 29, 2018

The Home Secretary will review police spending power and further options for reform when he presents the provisional police funding settlement in December.

Mr Hammond announced a further £650 million of grant funding for English local authorities for 2019/20, along with £45 million for the Disabled Facilities Grant in England in 2018/19 and £84 million over the next five years to expand the Children’s Social Care programmes to 20 further councils.

The Chancellor also announced an additional £1 billion for the Ministry of Defence in the period to the end of next year to boost cyber capabilities and anti-submarine warfare capacity and maintain the pace of the Dreadnought programme.

3.55pm

The Chancellor said the NHS 10-Year Plan will include a new mental health crisis service, with comprehensive mental health support available in every major A&E, children and young people’s crisis teams in every part of the country, more mental health ambulances, more “safe havens” in the community and a 24-hour mental health crisis hotline.

Today I can announce that the new NHS Plan will include a new mental health crisis service 👩⚕️👨⚕️ #Budget2018 pic.twitter.com/b0XoA0XWAQ

— HM Treasury (@hmtreasury) October 29, 2018

3.50pm

Borrowing this year will be £11.6 billion lower than forecast at the Spring Statement, at 1.2% of GDP, and is then set to fall from £31.8 billion in 2019/20 to £26.7 billion in 2020-21, £23.8 billion in 2021/22, £20.8 billion in 2022/23 and £19.8 billion in 2023/24, the Chancellor said.

Mr Hammond said he is predicted to meet his structural borrowing target three years early, with borrowing of 1.3% of GDP in 2020/21, maintaining £15.4 billion headroom.

The OBR confirms that debt peaked in 2016/17 at 85.2% of GDP and then falls in every year of the forecast from 83.7% this year; to 74.1% in 2023/24 – lower in every year than forecast at the Spring Statement – allowing the Government to meet its target to get debt falling three years early.

3.45pm

“The OBR expect growth to be resilient across the forecast period……improving next year from the 1.3% forecast at the Spring Statement……to 1.6%… 📈…then 1.4% in 2020 and 2021; 1.5% in 2022; and 1.6% in 2023.” #Budget2018 pic.twitter.com/0WAkm6h2e4

— HM Treasury (@hmtreasury) October 29, 2018

And today the OBR [is] …revising up participation in the labour market… … revising down the country’s…unemployment rate …delivering 800,000 more jobs by 2022. That’s over 4.1 million net new jobs since 2010…#Budget2018 pic.twitter.com/C0rjmq8c10

— HM Treasury (@hmtreasury) October 29, 2018

3.40pm

Getting the Brexit deal right will deliver a “double deal dividend”, said Mr Hammond. But he also announced an additional £500 million for no-deal preparations.

3.35pm

3.32pm

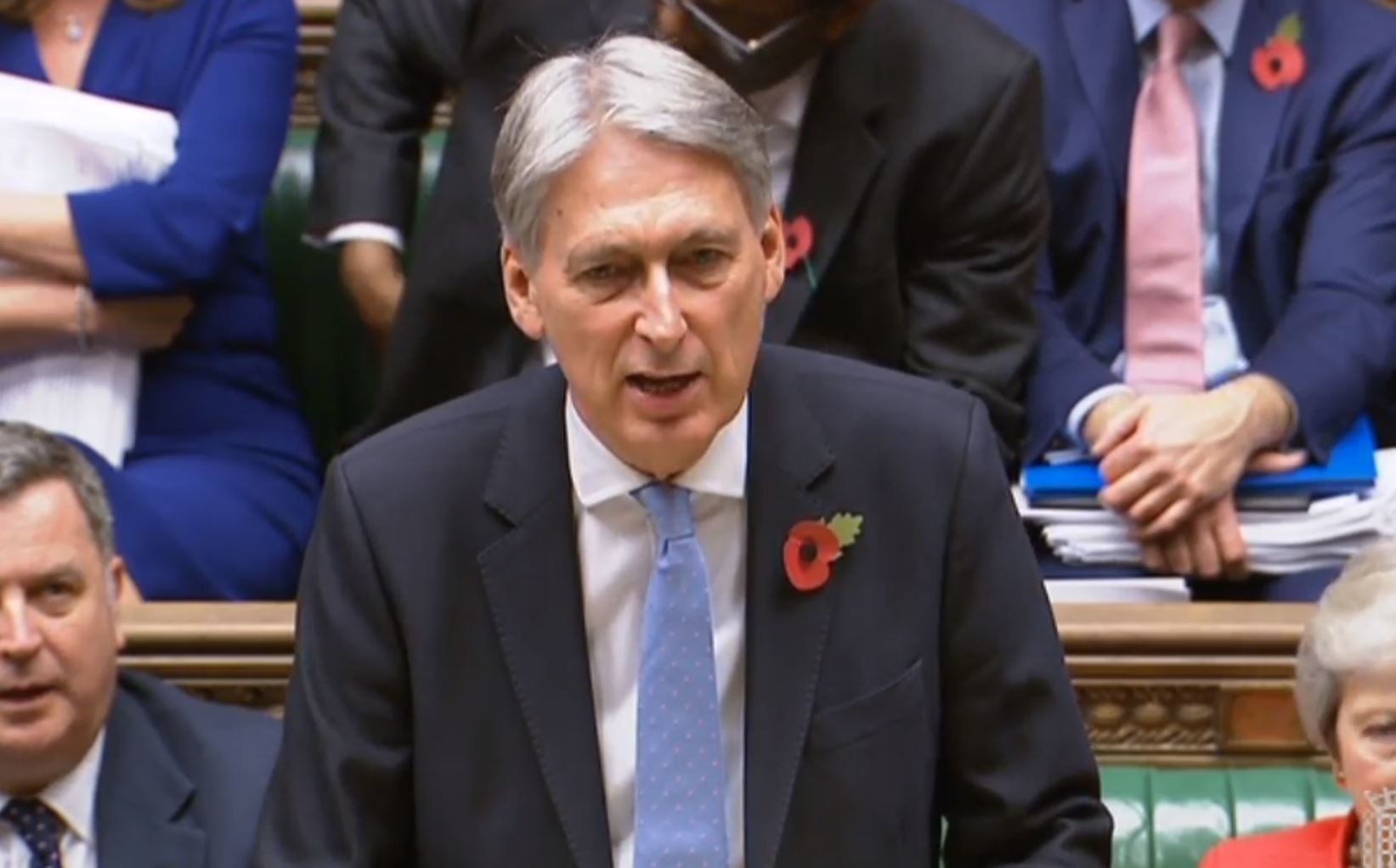

Chancellor Philip Hammond has risen to deliver his Budget speech.

Mr Hammond promised “a Budget for Britain’s future”.

3pm

Chancellor Philip Hammond has left Downing Street before delivering his Budget statement in the Commons.

This will be the last Budget before Brexit in March next year.

Putting the finishing touches to my Budget speech tonight. Tune in tomorrow at 3:30. #Budget2018 pic.twitter.com/zp9DueUOJG

— Philip Hammond (@PhilipHammondUK) October 28, 2018

Almost ready to go. #Budget2018 pic.twitter.com/uoIzITHGFJ

— Robert Jenrick MP (@RobertJenrick) October 29, 2018

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel